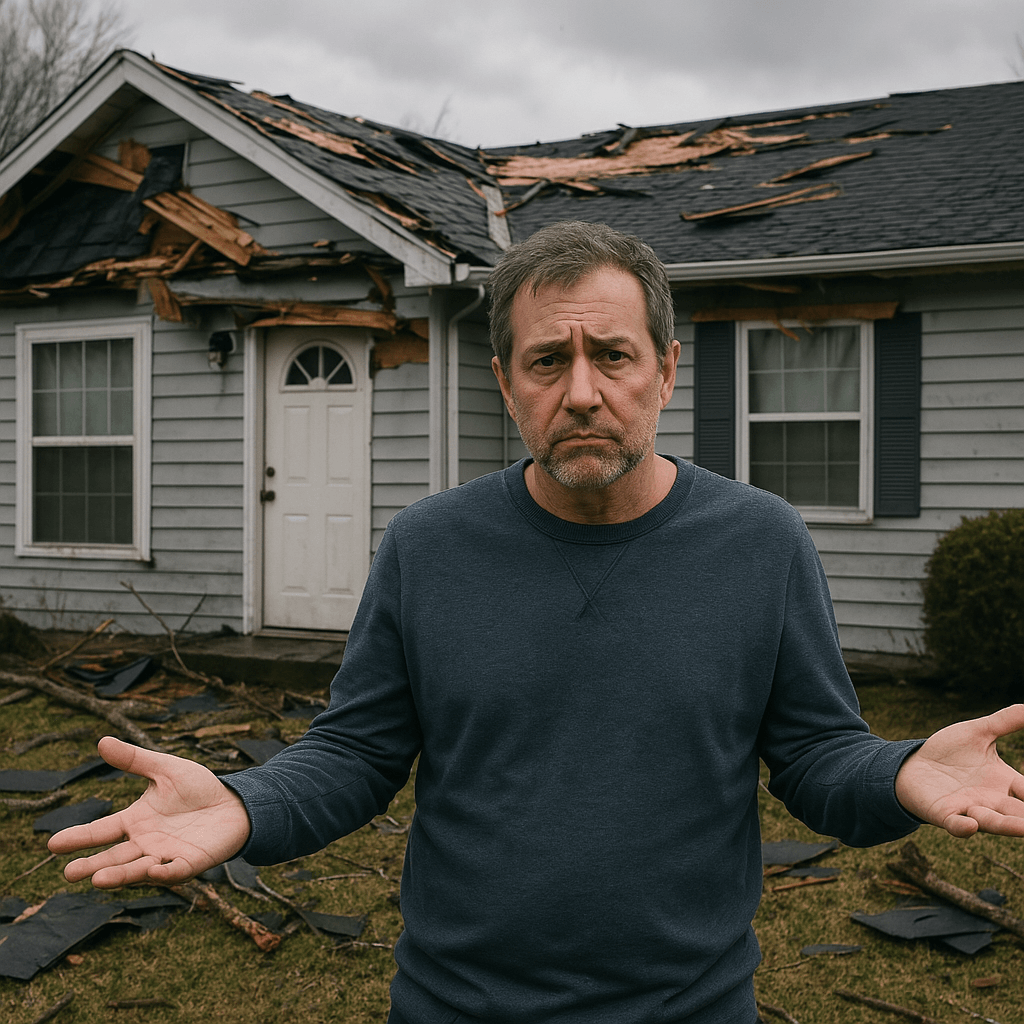

Dealing with a denied homeowners insurance claim can be incredibly frustrating, especially when you’re counting on that support to recover from damage or loss. Many homeowners assume their policy covers more than it actually does, only to be surprised when their claim is rejected.

Understanding the most common reasons for denial can save you time, money, and stress when it matters most. In this article, you’ll learn:

- The top mistakes that lead to claim denials

- How to prepare and file a stronger insurance claim

- Practical steps to reduce your risk of having your claim rejected

By knowing what red flags insurance companies look for, you can avoid the most common errors and protect your investment with confidence.

Policy Exclusions: The Fine Print That Bites Back

One of the leading causes of a denied homeowners insurance claim is a simple — but costly — misunderstanding of what your policy actually covers. Many homeowners are shocked to discover that certain types of damage aren’t covered at all, even after years of paying premiums.

Most standard policies exclude coverage for things like:

- Flood damage

- Earthquake damage

- Sewer backups

- Wear and tear or poor maintenance

- Pest infestations

If your roof leaks due to age, or your basement floods from rising groundwater, you could be left footing the bill because those events fall outside standard coverage. These exclusions are often listed in dense, hard-to-read sections of your policy — but they matter a lot when it comes time to file.

Why this leads to denials: Insurance companies expect you to maintain your property and prevent foreseeable damage. Claims related to long-term neglect, old materials, or unapproved upgrades often get flagged and rejected. Even if the damage feels sudden to you, adjusters look at whether it could have been prevented or predicted.

What you can do:

- Review your policy documents thoroughly, and ask your insurance agent about anything that seems unclear.

- Add supplemental coverage (like flood or earthquake insurance) if you’re in a risk-prone area.

- Keep records of maintenance and repairs — they help show you’ve done your part to prevent damage.

By understanding exclusions upfront, you’re far less likely to face a denied homeowners insurance claim due to a hidden clause you overlooked. It’s about setting realistic expectations — and protecting yourself before damage even happens.

Delayed Reporting: Why Waiting Can Cost You

Another major reason for a denied homeowners insurance claim is waiting too long to report the damage. It might seem harmless to take a few days to assess the situation, get a contractor’s opinion, or clean up before contacting your insurer — but that delay can seriously hurt your chances of getting approved.

Why timing matters:

Insurance companies often have strict timelines for reporting claims. Some policies require you to notify them “promptly” or “within a reasonable time,” which can vary from a few days to a couple of weeks, depending on the situation and the wording in your policy.

When you delay, you open the door to a few issues:

- Damage may get worse, making it harder to tell what was caused by the original event and what happened later.

- Evidence can be lost, cleaned up, or altered, which weakens your claim.

- Insurers may question the legitimacy of the damage or whether it’s even covered under your policy.

Common delay mistakes include:

- Trying to repair the damage before reporting it

- Assuming the issue is minor and will resolve on its own

- Waiting for quotes from contractors before calling your insurer

How to avoid this:

- Report damage as soon as it’s discovered, even if you’re not sure it’s covered.

- Take photos and videos immediately.

- Document the date and time of the event (like a storm or fire) and keep any receipts related to emergency fixes or inspections.

The longer you wait, the harder it becomes to prove your case. Fast action is one of the easiest ways to avoid a denied homeowners insurance claim, even if the damage seems small at first. The sooner you’re in touch with your insurance company, the stronger your position will be.

Lack of Documentation: When There’s Not Enough Proof

One of the fastest ways to end up with a denied homeowners insurance claim is by submitting weak or incomplete documentation. Even when your claim is legitimate, if the evidence isn’t there to back it up, your insurer may reject it outright.

Insurance companies rely heavily on documentation to validate what happened, how much it’s going to cost, and whether the event qualifies under your policy. Without solid proof, adjusters have little to go on — and that uncertainty often works against you.

What strong documentation looks like:

- Photos and videos taken immediately after the incident, showing damage in clear detail

- Receipts for damaged items or recent repairs and maintenance

- Estimates from licensed contractors for repairs or replacement

- Reports from inspectors or emergency services, if applicable

Common documentation mistakes:

- Taking blurry or incomplete photos

- Forgetting to document before cleanup or repairs

- Not tracking the date and time of the damage

- Submitting handwritten or vague repair estimates

The absence of proper documentation often leads adjusters to suspect exaggeration, neglect, or even fraud — all of which can result in a denied claim. Even honest mistakes or missing files can give the insurer a reason to say no.

How to stay prepared:

- Create a digital home inventory with photos of valuable items and receipts

- Store important documents in the cloud or an external drive

- Keep a running record of home repairs and maintenance

Having clear, time-stamped proof on hand helps build a solid foundation for your claim. Without it, the risk of a denied homeowners insurance claim increases dramatically — even when the damage is real and covered.

Misrepresentation or Errors: When the Details Don’t Match Up

Even small mistakes on your claim can lead to a denied homeowners insurance claim — especially if the details appear inconsistent or inaccurate. Whether intentional or not, insurers treat any form of misrepresentation as a red flag.

This can include things like:

- Overstating the value of damaged items

- Providing the wrong date or timeline of events

- Leaving out relevant details (like prior damage)

- Submitting different versions of the story to your agent, contractor, and adjuster

Why this matters:

Insurance adjusters are trained to look for discrepancies. If the story you give doesn’t match the evidence, or if different parts of your claim conflict with each other, it can trigger an investigation or outright denial. Even honest errors — like forgetting to mention a prior repair or giving an estimate off the top of your head — can work against you.

Where problems often start:

- Relying on memory instead of records

- Guessing rather than verifying item values or repair costs

- Miscommunication between you, your contractor, or your insurer

- Rushing through paperwork without reviewing it

How to avoid these pitfalls:

- Be honest and accurate, even if you’re unsure how it might affect the claim

- Double-check your paperwork before submitting anything

- Keep a copy of everything you send to your insurer

- If you’re unsure about how to word something, ask your agent for guidance

A denied homeowners insurance claim often comes down to mismatched information that raises doubts. By slowing down and checking every detail before submission, you improve your odds of getting approved — and avoid the stress of fighting a denial later.

How to Improve Your Chances of a Successful Claim

A denied homeowners insurance claim can set you back financially and emotionally, especially when you thought you were covered. Most denials come down to avoidable issues: missing the fine print on exclusions, waiting too long to report, lacking documentation, or making mistakes in your claim. By staying proactive — understanding your policy, documenting everything, and filing with accuracy — you significantly raise your chances of approval.

If you want better peace of mind before the next storm, fire, or unexpected event, take time to review your current coverage. A reliable policy can make all the difference when things go wrong. Learn more about your options and get the protection you need with quality Homeowners Insurance.